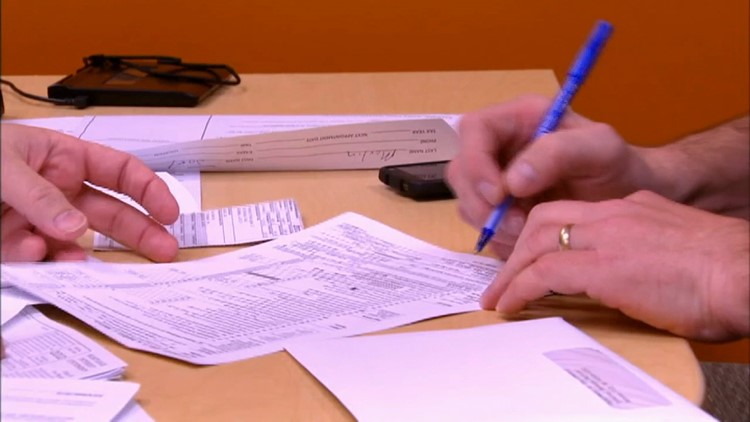

According to the Biden administration, families who qualify for the expanded and newly-advanceable child tax credit from the American Rescue Plan, will be able to start receiving an extra $300 July 15.

If one has already filed their taxes, they are one step ahead. However, some in Texas who have not filed their taxes yet have until June 15 to file, if they were affected by Winter Storm Uri.

Families who have not filed yet may still qualify for the child tax credit, if they are income eligible. The payment amount varies per child.

"Those in a lower tax bracket and a lower income bracket, if they're eligible for earned income credits, then they will also perhaps be eligible for the child tax credit. And that child tax credit is refundable. So, you have to have one to have the other. So, if they're eligible for that earned income credit, they're also eligible for the tax child credit. Then they can be eligible for a refund," managing member at Strategic Business Solutions Pamela Brown said.

President Joe Biden said this $110 billion economic impact could cut child poverty in half, including children in West Texas.

Rosemary Ramirez with WIC San Angelo said a family having this extra cash can be the difference between them choosing to pay bills versus paying to have food on the table.

"It will be a big relief to them. You know, it takes that stress off. It's a big stress not knowing if you're going to have that money to pay your rent or water bill or anything. Because when your kids are at home, that brings up all of your bills. It's an extra stress. Like, how am I going to make ends meet?" Ramirez said.

WIC San Angelo serves approximately 4,000 families

"If you've got income eligibility if you've got an earned income credit if you're in a lower income bracket, then yeah, there can be some really here for people based on that child tax credit," Brown said.

There are various child tax calculators to help people better understand how they may fall into this possible credit. However, Brown said it is made to give an idea and not an exact estimate.

Tax expert Brown said to keep in mind the IRS now having another extra 60 days to process these returns because of the extended deadline. Therefore, payments will take a little longer to come out for eligible child tax credit.